Property Tax Deferral and Addressing the 2020 Tax Rate

I have received a lot of feedback from residents since Council’s decision on Monday to approve the 2020 property tax by-laws and allow a deferral of property tax payments until September 30, 2020 . I voted in favour of the bylaws and the deferral program. Some of the feedback I’ve received is “how could we possibly raise taxes right now?” Others are saying we should cancel some of our priority capital projects to help lower the tax rate. Others are saying we should just cancel property taxes this year. There is no doubt that individuals and businesses are facing extreme challenges in these unprecedented times but, if we want to move forward we have to look at the facts. Now, I don’t expect to change the opinions of groups like the Canadian Taxpayers’ Federation, or even some of my Council colleagues but, I want to take some time here to outline some of the facts.

What Council Approved and What this Means for Individuals and Businesses

Council approved an effective 0% tax increase on the City portion for 2020. After adding in a number of other factors that is an 11.27% decrease for non-residential accounts and a 7.51% increase for residential accounts. That’s only an additional $150 in 2020 for a typical residential property with a $455,000 assessment. Here’s how we got to those numbers:

- Council approved an effective 0% increase for 2020 by approving a 1.5% increase and a 1.5% rebate;

- Council approved $13M to make-up for Provincial budget shortfall to the police budget;

- We shifted the ratio of property tax to 52% residential and 48% non-residential to help address the economic challenges that businesses in our City have been facing due to falling property values. We have about 500,000 residential accounts in the City compared to about 14,000 non-residential accounts. We needed to make this shift to help businesses and move to a more equitable tax distribution. It has far less impact to individual households to spread out more of the tax burden over about 500,000 residential accounts compared to the impact it would have on each of the only 14,000 non-residential accounts;

- Council approved a $30M municipal non-residential phased tax program to further assist businesses that have seen the highest tax increases.

I understand we are facing a big challenge right now, so Council has approved additional relief measures to support taxpayers facing financial hardship. Property tax bills will be mailed by the end of May as usual however, two new significant relief measures were approved to provide flexibility for taxpayers:

- The tax payment deadline has been extended from June 30 to September 30 without late payment penalties; and

- The Tax Installment Payment Plan (TIPP) has suspended its two per cent (2%) filing fee for taxpayers who join TIPP after January 1 , which has been suspended until January 1, 2021. This enables taxpayers who use The City’s monthly TIPP to cancel their monthly payments now and rejoin the program by September 30, 2020 to meet the tax payment deadline without administrative fees. There is no action required from property owners to access the deferral.

Is this a perfect solution? No. And we are continuing to explore other relief measures that we could provide. But we need to start somewhere and work with the facts: we need to continue to provide City services that are funded through property taxes, the City cannot run a deficit, we need to coordinate our efforts with other levels of government to get folks the most relief while maintaining the services we rely on, and cancelling capital priority projects is not the answer. I’ll explain what I mean:

The City Cannot Run a Deficit

According to Provincial legislation the City can’t run a deficit . Our income and expenses have to balance every year. The City also has very limited tools to generate revenue and property tax is the main tool. The other reality is that the overall effects of the global COVID-19 pandemic have put stresses on all areas of the City. Our first priority is to maintain the wellbeing of Calgarians and to do that we need to focus our efforts on sustaining City services that we all rely on; services like the fire department, the police, roads, and transit. While we are adapting the ways we deliver services, we must be aware of the revenue impacts the City is suffering. Presently Calgary Transit has seen a 90% reduction in C- Train ridership, along with a 70% reduction in key bus route and MAX ridership. No access to recreation centres or arts and cultural activities either. Lost revenue from closures and payment delays of utilities are some of the ways the City is losing revenue. We are losing an estimated total $15M a week . In the future, we can expect market volatility and economic conditions that challenge our ability to generate revenue. By laying the groundwork now, we can lessen the impact of the uncertainty that is to come. We cannot run a deficit to cover these losses or to provide the services that we rely on so we cannot simply cancel this year’s tax bills.

We Need a Coordinated Effort

We also need to coordinate with the relief programs that other orders of government are providing. Both the Federal and Provincial governments are providing a range of supports to individuals and businesses and we need to look at how the City can support an overall response while still providing the service that we rely on. The City is continuing to advocate to other orders of government for additional aid to vulnerable citizens, aid to businesses, aid to municipalities, stimulative infrastructure, and long term economic resilience and a new deal for cities.

Cancelling Priority Capital Projects is Not the Answer

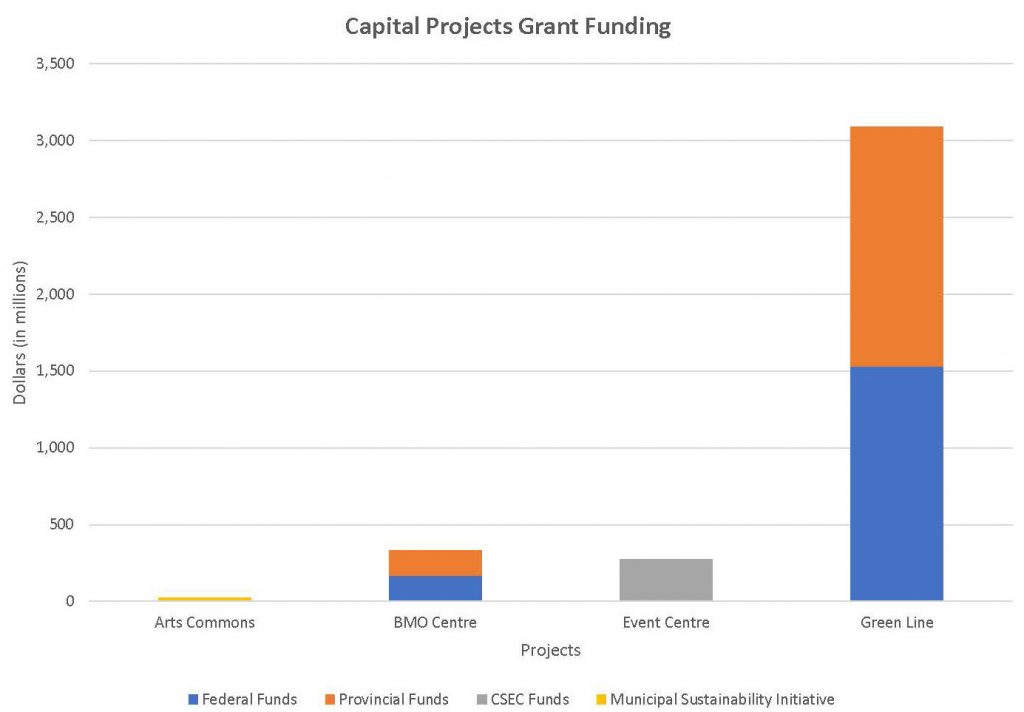

Now I am hearing some suggestions that we pull out of some big projects; namely the Green Line, the Event Centre, Arts Commons, the BMO Centre, and the Fieldhouse. I believe this would be a detriment to the long-term sustainability that is vital for Calgary’s prosperity. Firstly, cancelling these projects won’t realize a significant tax savings today. For most of these projects the dollars are being spent in future years. And, these projects are being paid for from funds other than property taxes. For example, the CRL or the MSI funds. Secondly, these projects will have a benefit for Calgary’s economy . The Arts Common, BMO Centre and Events Centre combined will add over an estimated $1B to Calgary’s economy. Moving forward with the BMO Centre and Arts Commons alone would create 6000 Jobs for Calgarians, which will be crucial during the recovery from the COVID-19 pandemic.

To desert our commitment to these projects would be leaving a significant amount of funding from other orders of Government on the table. We would be abandoning a potential of about $3.7B that likely would not be injected into Calgary otherwise.

This is a hugely difficult time for everyone and as a City we are continuing to work on ways to bring more relief. And we need to do that in light of the facts.

For more information on how to access the relief being provided by the City you can visit: https://www.calgary.ca/CSPS/cema/Pages/Response-to-Coronavirus.aspx .